September 2021 Revenue Assessment Report now available

Published on Tuesday, October 26, 2021

Providence, R.I. -- The Rhode Island Department of Revenue (DOR) today released its FY 2022 Revenue Assessment Report for September 2021. The Revenue Assessment Report, which is issued monthly, compares the adjusted general revenues by revenue source on a fiscal year-to-date and monthly basis to expected general revenues by revenue source. Expected general revenues are estimated by DOR’s Office of Revenue Analysis (ORA) from the revenue estimates included in the FY 2022 enacted budget signed into law on July 6, 2021 by Governor McKee.[1] The methodology underlying the Office of Revenue Analysis’ estimates is contained in Section II. of the entire report.

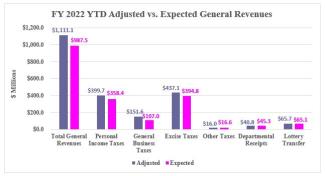

September Year-To-Date Performance. On a fiscal year-to-date basis, the September 2021 report shows that adjusted total general revenues are ahead of expected total general revenues, based on the FY 2022 revenue estimates included in the enacted budget and ORA’s estimation methodology, with adjusted total general revenues $123.6 million more than expected total general revenues, a variance of 12.5%. The results by general revenue category for the fiscal year-to-date through September period are as follows:

- General business tax revenues were up $44.7 million, or 41.8%, over expectations.

- Adjusted excise tax revenues were up $42.3 million, or 10.7% more than estimated.

- Personal income tax revenues were $41.2 million more than expected variance of 11.5%.

- Other taxes adjusted revenues were $654,876 below expectations, or ‑3.9%.

- Departmental receipts revenues trail the enacted estimate by $4.5 million or ‑9.9%.

- Adjusted lottery transfer revenues, reflecting July and August gaming activity, were $574,043, or 0.9%. ahead of the enacted estimate.

- Fiscal Year-to-Date Summary of Findings:

Regarding September year-to-date performance, Director of Revenue Guillermo L. Tello stated “the strong growth in total general revenues above expectations in the first quarter of the fiscal year is welcome and not dissimilar from what other states are seeing in their revenue performance.” Director Tello went on to note the following:

- Fiscal year-to-date adjusted total general revenues through September are $123.6 million ahead of expectations based on the enacted estimates included in the FY 2022 budget signed into law on July 6, 2021, a variance of 12.5%, 0.8 percentage points higher than August.

- FY 2022 year-to-date adjusted sales and use tax revenues through September exceed expectations by $41.8 million, or 12.1% continuing the strong year-to-date performance trend started in FY 2021.

- Adjusted personal income tax revenues through September are $41.2 million above the estimate, a variance of 11.5%, with final payments $17.8 million above the estimate, or 133.6%, withholding payments $15.8 million more than expected, or 5.1%, and estimated payments $8.1 million, or 13%, ahead of expectations.

- Business corporation tax adjusted revenues through September are $39.3 million more than estimated, a variance of 129.4% and could include some estimated payments made by C-corporations in anticipation of an increased TY 2021 tax liability associated with the taxation of Paycheck Protection Program (PPP) loan forgiveness of more than $250,000.

- Fiscal year-to-date through September financial institutions tax and insurance company gross premiums tax revenues are a combined $10.4 million greater than expectations, a variance of 26.6%.

- FY 2022 year-to-date departmental receipts, public utilities gross earnings tax, and estate and transfer tax adjusted revenues trail their respective estimates by a combined $10 million, a difference of ‑12%.

September Monthly Performance. For the month of September, the report shows that adjusted total general revenues are ahead of expected total general revenues, based on the enacted FY 2022 revenue estimates, with adjusted total general revenues $57 million more than expected total general revenues, a variance of 13.6%. The results by general revenue category for the September period are as follows:

- General business tax revenues were up $24.5 million, or 28.7%, over expectations.

- Personal income tax revenues were up $18.7 million, or 12.2% more than estimated.

- Excise tax revenues were $14.9 million more than expected a variance of 11.6%.

- Other taxes adjusted revenues were $522,221 above expectations, or 9.8%.

- Departmental receipts revenues trail the enacted estimate by $546,088 or ‑3.4%.

- Adjusted lottery transfer revenues, reflecting August gaming activity, were $932,815, or 2.9%. below the enacted estimate.

- Month of September Summary of Findings:

Regarding September 2021 monthly performance, Director of Revenue Guillermo L. Tello said that “the big three general revenue components, personal income tax, sales and use tax, and business corporation tax continue to lead state general revenues higher on a monthly basis.” Director Tello made the following observations:

- September adjusted total general revenues are $57 million ahead of expectations based on the estimates included in the FY 2022 enacted budget, a variance of 13.6%.

- In general business taxes, the September adjusted revenues for the business corporation tax are $27.1 million above the enacted estimates for September, a variance of 120.8%.

- Adjusted personal income tax revenues for September exceed expectations by $18.7 million, or 12.2%. Personal income tax revenues are led by final payments, which are $12.3 million more than expected for September, a variance of 205.2%. Personal income tax estimated and withholding payments adjusted revenues for September are a combined $6.8 million more than expected, a combined difference of 4.4%.

- Monthly sales and use tax revenues for September are $14 million above the estimate for September based on the enacted FY 2022 revenue estimate for sales and use taxes, a difference of 12.4%.

- Public utilities gross earnings tax adjusted revenues for September were behind the estimate by $3.2 million or ‑12.7%.

The entire report can be found on the Department of Revenue’s web site at http://www.dor.ri.gov/revenue-analysis/2022.php.

Questions or comments on the report should be directed to Paul Grimaldi, Chief of Information and Public Relations by e-mail at paul.grimaldi@revenue.ri.gov or by phone at (401) 378-1080.

[1] Revenue Assessment Reports for the FY 2022 July through October period use the enacted FY 2022 revenue estimates included in the enacted budget as the basis of comparison. Reports for the November through April period will use the revised FY 2022 revenue estimates adopted at the November 2021 Revenue Estimating Conference as the basis of comparison. The report for May will use the FY 2022 final revised revenue estimates adopted at the May 2022 Revenue Estimating Conference as the basis of comparison. The report for June will use the final enacted FY 2022 revenue estimates as the basis of comparison for preliminary FY 2022 audited revenues.