Revenue Assessment Report for October 2021 available

Published on Friday, November 19, 2021

(Providence, R.I.) -- The Rhode Island Department of Revenue (DOR) today released its FY 2022 Revenue Assessment Report for October 2021. The Revenue Assessment Report, which is issued monthly, compares the adjusted general revenues by revenue source on a fiscal year-to-date and monthly basis to expected general revenues by revenue source. Expected general revenues are estimated by DOR’s Office of Revenue Analysis (ORA) from the revenue estimates included in the FY 2022 enacted budget signed into law on July 6, 2021 by Governor McKee.[1] The methodology underlying the Office of Revenue Analysis’ estimates is contained in Section II. of the entire report. The information underlying the results in this report was available to the principals of the November 2021 Revenue Estimating Conference prior to their adoption of revised estimates for FY 2022. These revised estimates will be the basis of comparison for adjusted revenues beginning with the November Revenue Assessment Report.

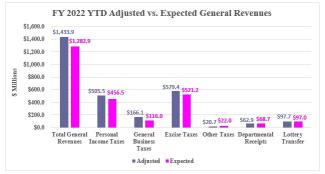

October Year-To-Date Performance. On a fiscal year-to-date basis, the October 2021 report shows that adjusted total general revenues are ahead of expected total general revenues, based on the FY 2022 revenue estimates included in the enacted budget and ORA’s estimation methodology, with adjusted total general revenues $151 million more than expected total general revenues, a variance of 11.8%. The results by general revenue category for the fiscal year-to-date through September period are as follows:

- Adjusted excise tax revenues were $58.4 million more than estimated, or 11.2%.

- General business tax revenues were up $50.1 million, or 43.2%, over expectations.

- Personal income tax revenues were $49 million more than expected a variance of 10.7%.

- Other taxes adjusted revenues were $1.4 million below expectations, or ‑6.3%.

- Departmental receipts revenues trail the enacted estimate by $5.8 million or ‑8.4%.

- Adjusted lottery transfer revenues, reflecting July through September gaming activity, were $632,483, or 0.7%. ahead of the enacted estimate.

- Fiscal Year-to-Date Summary of Findings:

Regarding October year-to-date performance, Director of Revenue Guillermo L. Tello stated “the strong growth in total general revenues above expectations in the first third of the fiscal year is welcome and not dissimilar from what other states are seeing in their revenue performance.” Director Tello went on to note the following:

- Fiscal year-to-date adjusted total general revenues through October were $151 million ahead of expectations based on the enacted estimates included in the FY 2022 budget signed into law on July 6, 2021, a variance of 11.8%, 0.7 percentage points lower than September.

- FY 2022 year-to-date adjusted sales and use tax revenues through October exceeded expectations by $59.1 million, or 12.9% continuing the strong year-to-date performance trend started in FY 2021.

- Adjusted personal income tax revenues through October were $49 million above the estimate, a variance of 10.7%, with final payments $23.6 million above the estimate, or 96.1%, withholding payments $17.4 million more than expected, or 4.3%, and estimated payments $11.1 million, or 15.8%, ahead of expectations. Personal income tax refunds and adjustments were $3.1 million above the estimate for October, a variance of 6.8%.

- Business corporation tax adjusted revenues through October were $35.7 million more than estimated, a variance of 98.4% and could include some estimated payments made by C-corporations in anticipation of an increased TY 2021 tax liability associated with the taxation of Paycheck Protection Program (PPP) loan forgiveness of more than $250,000.

- Fiscal year-to-date through October financial institutions tax and insurance company gross premiums tax revenues are a combined $18.1 million greater than expectations, a variance of 45.4%.

- FY 2022 year-to-date departmental receipts, public utilities gross earnings tax, cigarette and other tobacco products tax, and estate and transfer tax adjusted revenues trail their respective estimates by a combined $12.1 million, a difference of ‑7.4%.

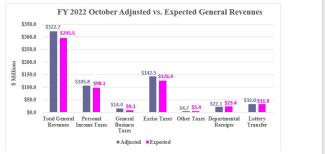

October Monthly Performance. For the month of October, the report shows that adjusted total general revenues are ahead of expected total general revenues, based on the enacted FY 2022 revenue estimates, with adjusted total general revenues $27.3 million more than expected total general revenues, a variance of 9.2%. The results by general revenue category for the October period are as follows:

- Excise tax revenues were $16.1 million more than expected a variance of 12.7%.

- Personal income tax revenues were up $7.7 million, or 7.9% more than estimated.

- General business tax revenues were $5.4 million, or 58.9%, over expectations.

- Other taxes adjusted revenues were $723,928 below expectations, or ‑13.4%.

- Departmental receipts revenues trail the enacted estimate by $1.3 million or ‑5.5%.

- Adjusted lottery transfer revenues, reflecting September gaming activity, were 0.2% more than the enacted estimate.

- Month of October Summary of Findings:

Regarding October 2021 monthly performance, Director of Revenue Guillermo L. Tello said that “three general revenue components, personal income tax, sales and use tax, and financial institutions tax led state general revenues higher on a monthly basis.” Director Tello made the following observations:

- October adjusted total general revenues were $27.3 million ahead of expectations based on the estimates included in the FY 2022 enacted budget, a variance of 9.2%.

- Monthly sales and use tax revenues for October were $17.3 million above the estimate for October based on the enacted FY 2022 revenue estimate for sales and use taxes, a difference of 15.4%.

- In general business taxes, the October adjusted revenues for the financial institutions tax were $7.7 million above the enacted estimates for October and public utilities gross earnings tax October adjusted revenues were $1.2 million more than the monthly estimate. These two surpluses more than offset the shortfall in business corporation tax revenues for October of $3.7 million.

- Adjusted personal income tax revenues for October exceed expectations by $7.7 million, or 7.9%. Personal income tax revenues were led by final payments, which were $5.9 million more than expected for October, a variance of 52.2%. Personal income tax estimated and withholding payments adjusted revenues for October were a combined $4.5 million more than expected, a combined difference of 4.2%. Personal income tax refunds and adjustments in October were $2.7 million above expectations or 12.8%.

- Departmental receipts adjusted revenues for October were behind the estimate by $1.3 million or ‑5.5% while cigarette and other tobacco products tax October adjusted revenues trailed the estimate by $1.6 million or 13.2%.

The entire report can be found on the Department of Revenue’s web site at http://www.dor.ri.gov/revenue-analysis/2022.php.

Questions or comments on the report should be directed to Paul Grimaldi, Chief of Information and Public Relations by e-mail at paul.grimaldi@revenue.ri.gov or by phone at (401) 378-1080.

[1] Revenue Assessment Reports for the FY 2022 July through October period use the enacted FY 2022 revenue estimates included in the enacted budget as the basis of comparison. Reports for the November through April period will use the revised FY 2022 revenue estimates adopted at the November 2021 Revenue Estimating Conference as the basis of comparison. The report for May will use the FY 2022 final revised revenue estimates adopted at the May 2022 Revenue Estimating Conference as the basis of comparison. The report for June will use the final enacted FY 2022 revenue estimates as the basis of comparison for preliminary FY 2022 audited revenues.

2021 (Providence, R.I.) -- The Rhode Island Department of Revenue (DOR) today released its FY 2022 Revenue Assessment Report for October 2021. The Revenue Assessment Report, which is issued monthly, compares the adjusted general revenues by revenue source on a fiscal year-to-date and monthly basis to expected general revenues by revenue source. Expected general revenues are estimated by DOR’s Office of Revenue Analysis (ORA) from the revenue estimates included in the FY 2022 enacted budget signed into law on July 6, 2021 by Governor McKee.[1] The methodology underlying the Office of Revenue Analysis’ estimates is contained in Section II. of the entire report. The information underlying the results in this report was available to the principals of the November 2021 Revenue Estimating Conference prior to their adoption of revised estimates for FY 2022. These revised estimates will be the basis of comparison for adjusted revenues beginning with the November Revenue Assessment Report.

October Year-To-Date Performance. On a fiscal year-to-date basis, the October 2021 report shows that adjusted total general revenues are ahead of expected total general revenues, based on the FY 2022 revenue estimates included in the enacted budget and ORA’s estimation methodology, with adjusted total general revenues $151 million more than expected total general revenues, a variance of 11.8%. The results by general revenue category for the fiscal year-to-date through September period are as follows:

- Adjusted excise tax revenues were $58.4 million more than estimated, or 11.2%.

- General business tax revenues were up $50.1 million, or 43.2%, over expectations.

- Personal income tax revenues were $49 million more than expected a variance of 10.7%.

- Other taxes adjusted revenues were $1.4 million below expectations, or ‑6.3%.

- Departmental receipts revenues trail the enacted estimate by $5.8 million or ‑8.4%.

- Adjusted lottery transfer revenues, reflecting July through September gaming activity, were $632,483, or 0.7%. ahead of the enacted estimate.

- Fiscal Year-to-Date Summary of Findings:

Regarding October year-to-date performance, Director of Revenue Guillermo L. Tello stated “the strong growth in total general revenues above expectations in the first third of the fiscal year is welcome and not dissimilar from what other states are seeing in their revenue performance.” Director Tello went on to note the following:

- Fiscal year-to-date adjusted total general revenues through October were $151 million ahead of expectations based on the enacted estimates included in the FY 2022 budget signed into law on July 6, 2021, a variance of 11.8%, 0.7 percentage points lower than September.

- FY 2022 year-to-date adjusted sales and use tax revenues through October exceeded expectations by $59.1 million, or 12.9% continuing the strong year-to-date performance trend started in FY 2021.

- Adjusted personal income tax revenues through October were $49 million above the estimate, a variance of 10.7%, with final payments $23.6 million above the estimate, or 96.1%, withholding payments $17.4 million more than expected, or 4.3%, and estimated payments $11.1 million, or 15.8%, ahead of expectations. Personal income tax refunds and adjustments were $3.1 million above the estimate for October, a variance of 6.8%.

- Business corporation tax adjusted revenues through October were $35.7 million more than estimated, a variance of 98.4% and could include some estimated payments made by C-corporations in anticipation of an increased TY 2021 tax liability associated with the taxation of Paycheck Protection Program (PPP) loan forgiveness of more than $250,000.

- Fiscal year-to-date through October financial institutions tax and insurance company gross premiums tax revenues are a combined $18.1 million greater than expectations, a variance of 45.4%.

- FY 2022 year-to-date departmental receipts, public utilities gross earnings tax, cigarette and other tobacco products tax, and estate and transfer tax adjusted revenues trail their respective estimates by a combined $12.1 million, a difference of ‑7.4%.

October Monthly Performance. For the month of October, the report shows that adjusted total general revenues are ahead of expected total general revenues, based on the enacted FY 2022 revenue estimates, with adjusted total general revenues $27.3 million more than expected total general revenues, a variance of 9.2%. The results by general revenue category for the October period are as follows:

- Excise tax revenues were $16.1 million more than expected a variance of 12.7%.

- Personal income tax revenues were up $7.7 million, or 7.9% more than estimated.

- General business tax revenues were $5.4 million, or 58.9%, over expectations.

- Other taxes adjusted revenues were $723,928 below expectations, or ‑13.4%.

- Departmental receipts revenues trail the enacted estimate by $1.3 million or ‑5.5%.

- Adjusted lottery transfer revenues, reflecting September gaming activity, were 0.2% more than the enacted estimate.

- Month of October Summary of Findings:

Regarding October 2021 monthly performance, Director of Revenue Guillermo L. Tello said that “three general revenue components, personal income tax, sales and use tax, and financial institutions tax led state general revenues higher on a monthly basis.” Director Tello made the following observations:

- October adjusted total general revenues were $27.3 million ahead of expectations based on the estimates included in the FY 2022 enacted budget, a variance of 9.2%.

- Monthly sales and use tax revenues for October were $17.3 million above the estimate for October based on the enacted FY 2022 revenue estimate for sales and use taxes, a difference of 15.4%.

- In general business taxes, the October adjusted revenues for the financial institutions tax were $7.7 million above the enacted estimates for October and public utilities gross earnings tax October adjusted revenues were $1.2 million more than the monthly estimate. These two surpluses more than offset the shortfall in business corporation tax revenues for October of $3.7 million.

- Adjusted personal income tax revenues for October exceed expectations by $7.7 million, or 7.9%. Personal income tax revenues were led by final payments, which were $5.9 million more than expected for October, a variance of 52.2%. Personal income tax estimated and withholding payments adjusted revenues for October were a combined $4.5 million more than expected, a combined difference of 4.2%. Personal income tax refunds and adjustments in October were $2.7 million above expectations or 12.8%.

- Departmental receipts adjusted revenues for October were behind the estimate by $1.3 million or ‑5.5% while cigarette and other tobacco products tax October adjusted revenues trailed the estimate by $1.6 million or 13.2%.

The entire report can be found on the Department of Revenue’s web site at http://www.dor.ri.gov/revenue-analysis/2022.php.

Questions or comments on the report should be directed to Paul Grimaldi, Chief of Information and Public Relations by e-mail at paul.grimaldi@revenue.ri.gov or by phone at (401) 378-1080.

[1] Revenue Assessment Reports for the FY 2022 July through October period use the enacted FY 2022 revenue estimates included in the enacted budget as the basis of comparison. Reports for the November through April period will use the revised FY 2022 revenue estimates adopted at the November 2021 Revenue Estimating Conference as the basis of comparison. The report for May will use the FY 2022 final revised revenue estimates adopted at the May 2022 Revenue Estimating Conference as the basis of comparison. The report for June will use the final enacted FY 2022 revenue estimates as the basis of comparison for preliminary FY 2022 audited revenues.