Revenue Assessment Report for November 2021 available

Published on Thursday, December 23, 2021

Providence, R.I. -- The Rhode Island Department of Revenue (DOR) today released its FY 2022 Revenue Assessment Report for November 2021. The Revenue Assessment Report, which is issued monthly, compares the adjusted general revenues by revenue source on a fiscal year-to-date and monthly basis to expected general revenues by revenue source. Expected general revenues are estimated by DOR’s Office of Revenue Analysis (ORA) from the revenue revised FY 2022 revenue estimates adopted at the November 2021 Revenue Estimating Conference (REC).[1] The methodology underlying the Office of Revenue Analysis’ estimates is contained in the report. The principals of the November 2021 REC revised FY 2022 total general revenues up by $273.6 million, with nearly all revenue items experiencing an upward revision. Details on the impact of the November 2021 REC by general revenue item can be found in the November 2021 Revenue Estimating Conference Report when it is published on the Office of Management and Budget’s website.

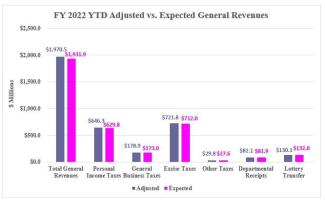

November Year-To-Date Performance. On a fiscal year-to-date basis, the November 2021 report shows that adjusted total general revenues are ahead of expected total general revenues, based on the revised FY 2022 revenue estimates adopted at the November 2021 REC and the Office of Revenue Analysis’ estimation methodology, with adjusted total general revenues $32.7 million more than expected total general revenues, a variance of 1.9%. The results by general revenue category for the fiscal year-to-date through November period are as follows:

- Personal income tax revenues are up $16.5 million, or 2.6%, over expectations.

- Sales and use taxes adjusted revenues for the fiscal year-to-date through November are $9.8 million more than expected, a variance of 1.6%.

- Business corporation taxes adjusted revenues are $8.4 million ahead of the estimate, or 11.4%.

- Estate and transfer revenues are $1.4 million more than expected, a variance of 8.1%.

- Lottery transfer adjusted revenues were $1.9 below expectations, or -1.4% on a fiscal year-to-date basis.

- Financial institutions tax adjusted revenues were less than the expected fiscal year-to-date financial institutions tax revised revenues by $1.1 million, a difference of ‑6.0%.

- Insurance company gross premiums tax revenues were $1.0 million less than expected fiscal year-to-date insurance company gross premiums tax revised revenues, a difference of ‑2.6%.

November Monthly Performance. For the month of November, the report indicates that adjusted total general revenues were also $32.7 million above expectations for the month or a variance of 10.3%. The methodology employed by ORA post the November Revenue Estimating Conference effectively makes November the first month of the November 2021 through April 2022 reporting period so the nominal differences for the monthly revenues are the same as the nominal differences for the fiscal year-to-date revenues. The variances, however, will be larger for the monthly revenues due to the smaller base from which the nominal differences are measured.

The entire report can be found on the Department of Revenue’s web site at http://www.dor.ri.gov/revenue-analysis/2022.php.

Questions or comments on the report should be directed to Paul Grimaldi, Chief of Information and Public Relations by e-mail at paul.grimaldi@revenue.ri.gov or by phone at (401) 378-1080.

[1] Revenue Assessment Reports for the FY 2022 July through October period use the enacted FY 2022 revenue estimates included in the enacted budget as the basis of comparison. Reports for the November through April period will use the revised FY 2022 revenue estimates adopted at the November 2021 Revenue Estimating Conference as the basis of comparison. The report for May will use the FY 2022 final revised revenue estimates adopted at the May 2022 Revenue Estimating Conference as the basis of comparison. The report for June will use the final enacted FY 2022 revenue estimates as the basis of comparison for preliminary FY 2022 audited revenues.