Revenue Assessment Report for January 2022 available

Published on Friday, February 25, 2022

Providence, R.I. -- The Rhode Island Department of Revenue (DOR) today released its FY 2022 Revenue Assessment Report for January 2022. The Revenue Assessment Report, which is issued monthly, compares the adjusted general revenues by revenue source on a fiscal year-to-date and monthly basis to expected general revenues by revenue source. Expected general revenues are estimated by DOR’s Office of Revenue Analysis (ORA) from the revenue revised FY 2022 revenue estimates adopted at the November 2021 Revenue Estimating Conference (REC).[1] The methodology underlying the Office of Revenue Analysis’ estimates is contained in the report. The principals of the November 2021 REC revised FY 2022 total general revenues up by $273.6 million, with nearly all revenue items experiencing an upward revision. Details on the impact of the November 2021 REC by general revenue item can be found in the November 2021 Revenue Estimating Conference Report when it is published on the Office of Management and Budget’s website.

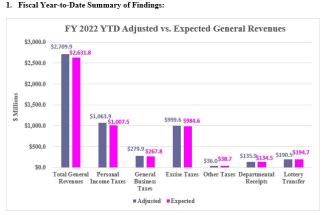

January Year-To-Date Performance. On a fiscal year-to-date basis, the January 2022 report shows that adjusted total general revenues are ahead of expected total general revenues, based on the revised FY 2022 revenue estimates adopted at the November 2021 REC and the Office of Revenue Analysis’ estimation methodology, with adjusted total general revenues $78.1 million more than expected total general revenues, a variance of 3.0%. The results by general revenue category for the fiscal year-to-date through January period are as follows:

- Personal income tax revenues are up $56.5 million, or 5.6%, over expectations.

- Sales and use taxes adjusted revenues for the fiscal year-to-date through January are $16.3 million more than expected, a variance of 1.9%.

- Business corporation taxes adjusted revenues are $15.4 million ahead of the estimate, or 14.2%.

- Departmental receipts were up $1.4 million, or 1.1%, over expected departmental receipts revised revenues for FY 2022 year-to-date.

- Insurance company gross premiums tax revenues were $1.1 million more than expected fiscal year-to-date insurance company gross premiums tax revised revenues, a difference of 1.6%.

- Public utilities gross earnings tax adjusted revenues were $3.0 million, or 6.3%, less than revised public utility gross earnings tax expected fiscal year-to-date revenues.

- Lottery transfer revenues were $4.2 million less than expected fiscal year-to-date revised revenues from the lottery transfer, a difference of ‑2.2%.

- Estate and transfer tax adjusted revenues were $2.9 million, or 11.7%, below revised estate and transfer tax expected fiscal year-to-date revenues.

- Financial institutions tax adjusted revenues were less than the expected fiscal year-to-date financial institutions tax revised revenues by $1.3 million, a difference of ‑6.4%.

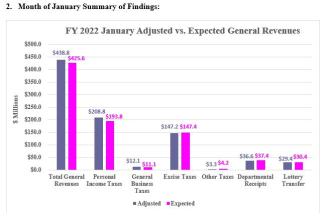

January Monthly Performance. On a monthly basis, the January 2022 report shows that adjusted total general revenues are ahead of expected total general revenues, based on the revised FY 2022 revenue estimates adopted at the November 2021 REC and the Office of Revenue Analysis’ estimation methodology, with adjusted total general revenues $13.2 million above expectations for the month, a variance of 3.1%. The results by general revenue category for the month of January 2022 period are as follows:

- Personal income tax revenues were up $15.0 million, or 7.7%, over expectations.

- Business corporation tax were up $1.6 million, or 24.8%, compared to expected business corporation tax revised revenues for January.

- Sales and use tax adjusted revenues were $1.2 million more than expected monthly sales and use tax revenues based on the revised estimate, a difference of 0.9%.

- Alcohol excise tax adjusted January revenues were up $1.3 million, or 63.5%, over expected alcohol excise tax revised revenues for January.

- January cigarette and other tobacco products (OTP) taxes adjusted revenues were $2.6 million, or 21.2%, below revised cigarette and OTP taxes expected monthly revenues.

- Insurance company gross premiums tax revenues were $1.0 million less than expected monthly insurance company gross premiums tax revised revenues, a difference of -95.1%.

- Estate and transfer tax adjusted revenues for January were $1.0 million, or 51.1%, below revised estate and transfer tax expected monthly revenues.

- Adjusted January lottery transfer revenues were $1.0 million less than expected monthly revised revenues from the lottery transfer, a difference of ‑3.3%.

The entire report can be found on the Department of Revenue’s web site at https://dor.ri.gov/fiscal-year-2022

Questions or comments on the report should be directed to Paul Grimaldi, Chief of Information and Public Relations by e-mail at paul.grimaldi@revenue.ri.gov or by phone at (401) 378-1080.

[1] Revenue Assessment Reports for the FY 2022 July through October period use the enacted FY 2022 revenue estimates included in the enacted budget as the basis of comparison. Reports for the November through April period will use the revised FY 2022 revenue estimates adopted at the November 2021 Revenue Estimating Conference as the basis of comparison. The report for May will use the FY 2022 final revised revenue estimates adopted at the May 2022 Revenue Estimating Conference as the basis of comparison. The report for June will use the final enacted FY 2022 revenue estimates as the basis of comparison for preliminary FY 2022 audited revenues.