Cash Collections Report for October 2021 available

Published on Tuesday, November 23, 2021

(Providence, R.I.) -- The Rhode Island Department of Revenue today released its FY 2022 Cash Collections Report for October 2021. The Cash Collections Report, which is issued monthly, compares current fiscal year cash collections by revenue item on a fiscal year-to-date and monthly basis to prior fiscal year cash collections by revenue item. The cash collections report makes no adjustments for the timeliness of the receipt of revenues and provides readers with insight into the state’s cash flow over the course of the fiscal year.

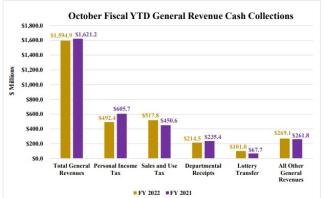

Rhode Island Department of Revenue Director Guillermo L. Tello noted: “FY 2022 total general revenue cash collections through October are down 1.6%, or $26.3 million, from last fiscal year through October. This negative difference is due to the extension of the TY 2019 tax filing and payment deadlines from April 15 and June 15, 2020 to July 15, 2020 for personal income and nearly all business taxes. In total, $201.3 million in cash receipts directly related to the delay in the filing and payment due dates to July 15, 2020 were received in July 2020 (FY 2021) that otherwise would have been paid in April through June 2020. After accounting for the receipt of TY 2019 tax payments in July 2020, FY 2022 cash collections are ahead of last fiscal year through October by 12.3%.

- FY 2022 personal income tax cash collections through October were $113.3 million less than in FY 2021. Approximately $151.9 million of personal income tax cash collections in FY 2021 through October were the result of the delay in the TY 2019 filing and payment due dates to July 15, 2020.

- FY 2022 sales and use tax cash collections through October were $67.2 million more than in FY 2021 through October. Fiscal year to date sales and use tax cash collections through October generally reflect retail sales activity that occurred in July through September of the fiscal year.

- Departmental receipts cash collections trailed the same period last fiscal year by $20.9 million with most of this shortfall attributable to the reduction in the hospital licensing fee rate to 5% for FY 2021 (prior fiscal year hospital licensing fee payments are received in July of the current fiscal year).

- FY 2022 year-to-date other general revenues cash collection, excluding business corporation tax cash collections, are $1.3 million below FY 2021 year-to-date amounts while business corporation tax cash collections in FY 2022 through October are $11.9 million more than in the same period in FY 2021.

- The fiscal year-to-date lottery transfer cash receipts were $33.4 million more in FY 2022 than in FY 2021, reflective of the fact that the state’s two casinos have returned to full operations in FY 2022 vs. the limited capacity restrictions that were in place in FY 2021.”

Notable cash collections items on a October fiscal year-to-date basis included:

- Total personal income tax cash collections of $492.4 million, down $113.3 million or 18.7% year-to-date. The net decrease in personal income tax cash collections breaks down as follows:

- Personal income tax estimated payments down $19.6 million or 19.4% fiscal year-to-date, with $29.0 million in TY 2019 delayed payments received in FY 2021 year-to-date through October.

- Personal income tax final payments down $144.3 million or 80.4% fiscal year-to-date, with $142.2 million the result of the extension of the TY 2019 return due date to July 15, 2020.

- Personal income tax refunds and adjustments down $19.2 million or 28% year-to-date, with $19.3 million of refunds paid in FY 2021 year-to-date through October that were accrued back to FY 2020.

- Personal income tax withholding payments in year-to-date FY 2022 were $31.4 million more than in year-to-date FY 2021, a growth rate of 8%, ahead of the 1.5% growth rate recorded in FY 2021 for the same period.

- Year-to-date FY 2022 sales and use tax cash collections were up 14.9% in comparison to FY 2021 through October. Total non-motor vehicle sales and use tax collections were $64.8 million higher, including $25 million more in meal and beverage receipts. Motor vehicles use tax receipts (i.e., Registry Receipts) were 4.9% more in FY 2022 year-to-date than the same period in FY 2021.

- FY 2022 all other general revenue sources cash collections through October were $7.4 million more than last fiscal year through October. Business corporation tax cash collections through October 2021 are $11.9 million more than in FY 2021 through October 2020 despite an additional $27.2 million of cash received in FY 2021 due to the delayed filing and payment deadlines in FY 2021. Conversely, FY 2022 through October insurance company gross premiums tax cash collections are $10.9 million less than in FY 2021 year-to-date due in large part to the receipt of $13.7 million in delayed payments received in July 2020. Financial institutions tax cash collections are $12.2 million more in FY 2022 through October than in FY 2021 through October and realty transfer tax cash collections in year-to-date FY 2022 are $1.7 million more than for the same period last fiscal year helping to offset in part a shortfall of $3.7 million in estate and transfer tax, $1.3 million in public utilities gross earnings tax, $1.5 million in health care provider assessment, and $2.1 million in cigarette and other tobacco products tax cash collections.

- Fiscal year-to-date through October 2021 departmental receipts cash collections are $20.9 million, or 8.9%, less than in FY 2021 through October. FY 2021 hospital licensing fees, which were paid in July 2021 were $21.1 million less than FY 2020 hospital licensing fees that were received in July 2020 due in large part to a reduction in the hospital licensing fee rate from 6% to 5% for FY 2021.

- The FY 2022 lottery transfer year-to-date through October, reflecting July through September gaming activity, was $33.4 million more than in the same period in FY 2021 with increases in every lottery component.

- Traditional lottery games were $1.5 million more in FY 2022 through October than in FY 2021 for the same period.

- The state’s share of net terminal income generated by the video lottery terminals (VLTs) in operation at the Twin River and Tiverton Casino Hotels were $26 million above the same period in the prior year.

- The transfer to the state from the table games operated at the two casinos was $2.2 million more than in FY 2021 through October.

- On-site and remote sports betting revenues were $2.2 million more in FY 2022 through October than in the same period in FY 2021.

“For the month of October, total general revenues cash collections were $48.4 million more in 2021 than in 2020,” stated Department of Revenue Director Tello. “The strong monthly performance in October 2021 marks the third consecutive month in which general revenue cash collections exceeded the same month in the prior fiscal year by more than $45 million.”

Notable cash collections items for the month of October included:

- Total personal income tax cash collections of $104.4 million, up $13.5 million or 14.8% year-to-date. The net increase in personal income tax cash collections breaks down as follows:

- Personal income tax estimated and final payments up a combined $3.4 million or 14.6% year-over-year. October 2021 personal income tax final payments includes $195,459 of reimbursed historic structures tax credit redemptions vs. $2.7 million in October 2020.

- Personal income tax refunds and adjustments down $1.9 million or 7.4% year-over-year.

- Personal income tax withholding payments in October 2021 $8.2 million more than in October 2020, or 8.8%, well above the ‑4.1% growth rate recorded in FY 2021 for the same period.

- October 2021 sales and use tax cash collections up 16.2% in comparison to October 2020 with total non-motor vehicle receipts $17.9 million higher, including $5 million more in meal and beverage sales tax receipts. Motor vehicles use tax receipts (i.e., Registry Receipts) were 0.7% more in October 2021 vs. October 2020.

- Monthly all other general revenue sources cash collections are up $6.7 million relative to October 2020. This increase is largely attributable to an increase in cash receipts for the financial institutions tax, which increased $5.6 million or 263.4% year-over-year.

- Year-over-year departmental receipts cash collections for October 2021 are in line with October 2020.

- The October 2021 lottery transfer is $10.2 million, or 40.6%, more than in October 2020 due to strong performance in VLTs in operation at the Twin River and Tiverton Casino Hotels, which transferred $7.6 million more to general revenues than in October 2020.

The full cash collections report can be found on the Department of Revenue’s web site, www.dor.ri,gov, under the Revenue Analysis directory or at this link: http://www.dor.ri.gov/revenue-analysis/2022.php under the State Reports tab.

Questions or comments on the report should be directed to Paul Grimaldi, Chief of Information and Public Relations by e-mail at paul.grimaldi@revenue.ri.gov or by phone at (401) 378-1080.